Integration, Integration, Integration (Plus a Smattering of Confluence)

On January 11th, Appfire announced their acquisition of 20 Atlassian Marketplace apps from ServiceRocket, adding to their already substantial portfolio for 2023. This takeover confirms what we’ve been seeing both with Appfire’s ongoing acquisition strategy and with trends in the Atlassian partner ecosystem as a whole.

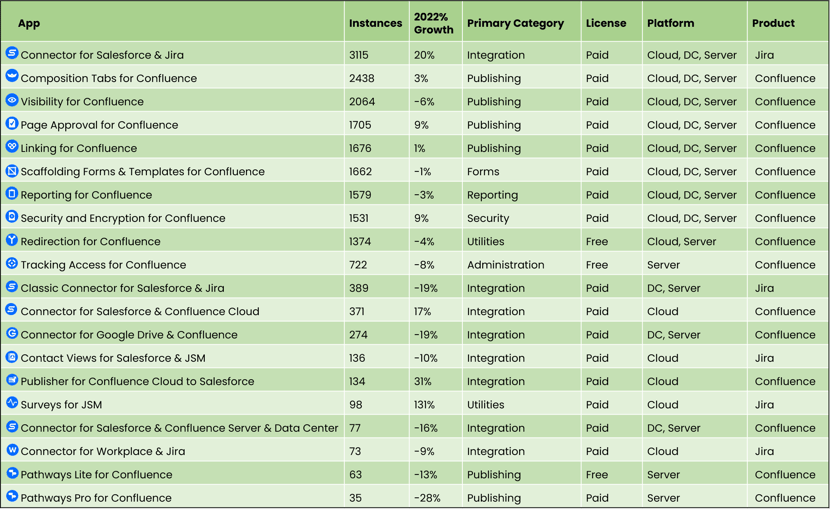

For Appfire, this represents another cross-platform acquisition. ServiceRocket’s largest app integrates between Salesforce and Jira (see Figure 1) and has grown significantly over the past year. Meanwhile, Appfire’s two previous acquisitions have also been of apps operating on and/or integrating with various non-Atlassian platforms. These platforms include: Nextup.ai with their strong Microsoft & Slack presence and 7pace from the Azure DevOps and GitHub ecosystems. Clearly Appfire see cross-platform tools that can help break down tool-induced silos as a very significant area of growth going forward.

Meanwhile, for the Atlassian ecosystem as a whole, this represents another example of the increasing trend towards specialized Marketplace Partners and specialized Solution Partners. An increasing amount of Solution Partners are selling off their app portfolios and choosing to focus solely on providing services to customers. This is a trend we think is likely to continue going forward as these differing business models naturally separate into more specialized organizations.

Appfire’s Growing Portfolio

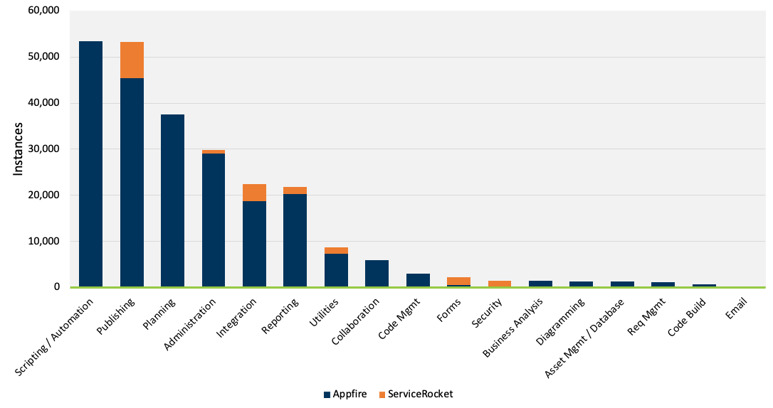

Interestingly, while the acquisition of ServiceRocket was strategically most important to Appfire given its integrations with Salesforce, the biggest impact instance-wise will be on Appfire’s suite of Publishing apps.

Publishing is now nearly Appfire’s largest category, with it getting very close to Scripting/Automation. Appfire’s Integration portfolio has also naturally shown a significant increase following this acquisition (Figure 2).

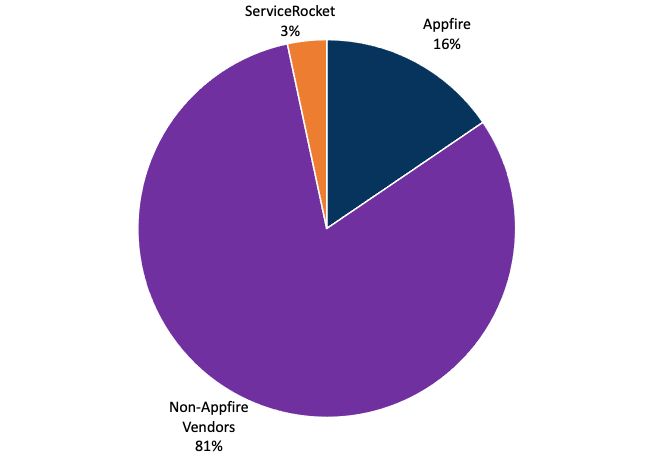

This also means that Appfire have expanded their presence in the Confluence–now with nearly 20% app market share, even a major diagramming application to bolster these numbers.

Cross Platform Integrations

As shown in Figure 1, Connector for Salesforce & Jira grew excellently over 2022. Its growth of 20% over the year speaks to both its ability to effortlessly integrate between Jira and Salesforce as well as the growing demand by customers for tools that will cross platforms like this.

As Appfire stated:

Today, teams choose their own tools, but that can often lead to a lot of context-switching when different teams across the enterprise try to work together. Customers need powerful yet simple products that enable new ways to improve collaboration, productivity and business processes.

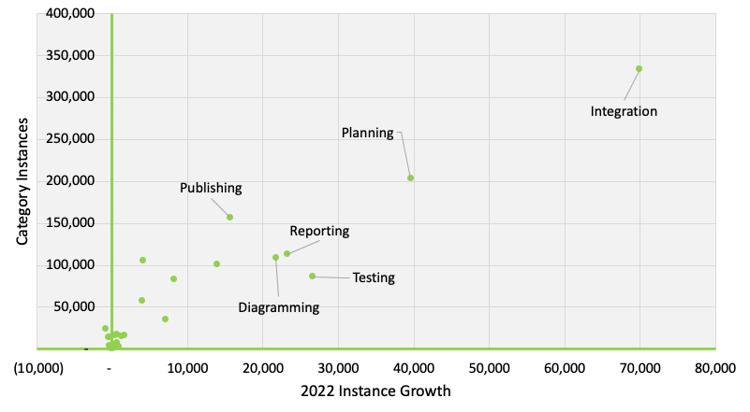

And this is a viewpoint shared by both ourselves and our MARS Atlassian Marketplace data. As Figure 4 shows, Integration is the largest category of apps and was also the fastest growing over 2022, adding nearly 70,000 instances (the next closest was Planning with 40,000 in comparison). Clearly, Atlassian customers are using many tools and are seeing the importance of having them talk to one another.

Furthermore, at Contegix, we love integration tools since they help in the fight against the growing trend of what we see as “Fortress Architectures”.

Fortress Architectures

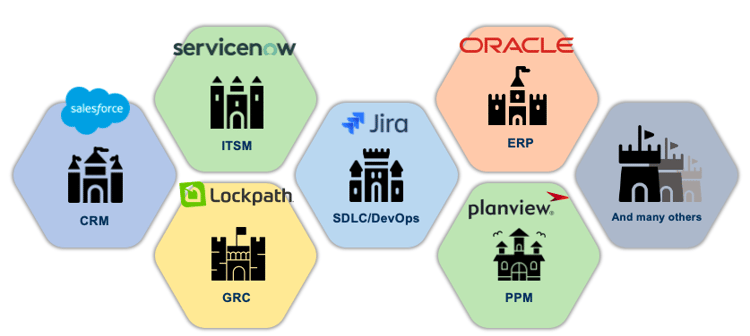

What we mean by “Fortress Architectures” is the increasing disconnect between popular methodologies (like ITIL, SAFe, and Integrated GCR) and these “Fortress Architectures”.

While these methodologies strive for integration and connectedness, we find that they often come up against these fortress architectures that don’t allow for this due to their insistence on control.

This is partly down to this kind of “Gartner approach” to tool selection—with organizations buying whatever the supposed leader in a market segment is–as well as these tools, and those operating them, generally tend to be very interested in controlling their segment and making sure they own that world making integrating between them very difficult.

In one sense it is beneficial that these are generally the best tools for these jobs (perhaps not in the case of ServiceNow in ITSM) and teams deserve do use the tools best suited to their specific requirements. However, when information, data, and thinking gets siloed in tools, organizational best practices become ineffective. As we can see in Figure 5, Salesforce is the dominant force in CRM while Jira is the same for SDLC/DevOps. In this example, a tool like Connector for Salesforce & Jira can form an invaluable bridge between these tools, letting these fortresses lower their defenses and work constructively with one another.

The Wrap

Overall, we think this acquisition is unique in the development of the Atlassian ecosystem and beyond, as platforms continue to communicate increasingly with one another.

If you want to learn more about the acquisition then you can find Appfire’s press release here.

You can also get in touch with us if you’re interested in learning more about any of our unique offerings.